Business

6 Ways Your Investments Can Fund Racial Justice

Protests against racism have demanded that we take action in our police department and other systems that historically oppressed people with color, including the financial system.

You can also join the protests by donating to organizations fighting for racial injustice or shopping at Black-owned companies.

“What comes after protests is money, and money is what will make change sustainable,” says Tiffany Aliche, a financial educator and founder of The Budgetnista.

These are six ways you can support racial equality with your investment portfolio.

1. Invest in Black-owned businesses and funds that support racial Justice

Kenneth Chavis is a senior wealth manager at LourdMurray and a certified financial planner. He says that investing in stocks of Black-owned businesses can offer two main benefits to investors: diversification as well as the potential for high performance.

Diversification, which means spreading your portfolio among companies from different industries and locations, is crucial to reducing your risk. It also helps you choose companies with different sizes. Chavis points out that small businesses are known for their potential growth. “Keeping in mind the fact that some Black-owned businesses are smaller, there are tons of research that suggests that the probability that a small company will outperform the average big company over long periods of times — or just the broad marketplace — is extremely high.” You’ll need to carefully vet your investment.

There are very few of these stocks that are listed on the public exchanges. It is difficult to weed through stocks and build a portfolio without extensive research. So another option is to use your dollars to invest in mutual funds or exchange-traded funds that will do that work for you. The NACP ETF tracks Morningstar Minority Empowerment Index. It provides exposure to companies that comply with the NAACP guidelines. However, the NAACP does not endorse or sponsor the fund. All net advisory profits from the fund’s management fees are donated to NAACP. There is also a growing number of ESG funds, or funds that are graded using environmental, social and governance criteria.

2. Explore peer-to-peer lending

Peer-to-peer lending companies like SoLo Funds give people who have historically been overlooked by financial institutions and traditional loan programs the ability to access capital. The terms of the loan are set by SoLo borrowers, with no formal approval. Lenders get “appreciation tips” and there are no minimum requirements. You can start with any amount.

Chavis states that peer-to-peer lending is beneficial for asset diversification. P2P loans are not usually correlated with the stock market. He adds that it is a great way to assist disadvantaged communities to access capital for personal or business purposes.

One of the main risks associated with P2P lending is that the borrower might not be able repay the loan. SoLo attempts this by giving every borrower a SoLo score. This acts as a platform-specific credit rating and is based upon your initial registration and how your loans have been handled. Chavis recommends that you diversify the loans you offer. This will help reduce risk.

3. 3.Invest in companies that support racial justice financially

Public companies can be rewarded with your investment dollars if they donate money to support racial equality. Many large corporations have made pledges of money over the years to support anti-racism initiatives. You are supporting companies that put their money where it is needed by investing in them. It is also possible to see if the company has a CSR initiative, which supports local communities.

Aliche also says that spending money is the same as investing money. You might not see a return if your stock is not actually owned by you, but you are putting money into these companies.

She recommends that you review the company’s website, social media and who is on their staff before spending any money. Aliche says it is crucial to spend your money with companies who are aligned.

4. Look into real estate crowdfunding or startups

Although you may not yet be an angel investor, you can still invest in cool startups that aren’t yet publicly traded. Republic lets investors find emerging businesses for as low as $10 and get in on ground floor. The site also lets you filter listed businesses to those with Black founders (as well as to those with female founders and other socially responsible investing criteria).

Buy the Block is a crowdfunding platform that allows you to invest in real property and in some cases the businesses they will house. It’s all about giving people an equity stake in their communities, as well as working to stop gentrification. You can invest on Buy the Block for a minimum of $100 (which is significantly less than most real estate crowdfunding platforms). Many of the projects on Buy the Block are located in historically Black neighborhoods.

You could lose all of your investment in real estate crowdfunding or startups. Do your research before you make any investment.

5. 5. Rethink your bank

Consider a Black-owned bank if your current bank isn’t meeting your needs. A 2019 FDIC study found that minority deposit institutions are more likely to originate mortgage loans for minorities than non MDIs. Some institutions are also designated Community Development Financial Institutions. This means that 60% of their financing activities are geared towards low- and medium-income people.

Aliche says, “I love small, local banks.” “Don’t hesitate to ask about initiatives for the African American community at banks that reinvest in your community. They might have more community-focused initiatives even if they aren’t African American-owned banks.

6. Learn from and collaborate with Black financial professionals

Working with a Black financial advisor not only invests your money back into the community, it helps that advisor continue adding their perspective to the predominantly white space of financial advice. The Association of African American Financial Advisors has a list of Black financial advisors.

Black-owned investment platforms offer financial guidance and can be used to help you invest. Freeman Capital, a Black-owned, -founded investment platform, recognizes the wealth gap and provides everything you need, from automated investing to consultations and CFPs.

Business

How Businesses Utilize Custom-Printed Balloons To Stand Out At Events

There’s always plenty to see at events, all carrying different messages, brands, and graphics. Businesses seek effective yet cost-efficient methods of getting noticed at neighborhood fairs, trade events, product launches, and shop openings – custom printed balloons offer one such simple yet effective means – when utilized wisely, they help companies get noticed more effectively, create lasting memories more naturally, while strengthening their identity without seeming forced or faked out.

Visual Impact For Quick Visual Results

First impressions matter at events where attendees must quickly make choices about where and who to visit, such as launches of personalized balloons at events. Balloons printed with your design add height, color, and movement right away, while being easy to see in dense environments due to being larger and catching people’s eyes from all directions in a room.

Companies can turn balloon decorations into promotional tools by printing logos, slogans, or campaign messaging directly on balloons. These graphics draw people’s attention naturally, whether hung over a booth or framing an entrance – without needing to be actively promoted!

How Brand Identity Is Shaped Through Design

Brand consistency is at the center of successful branding efforts, so companies may use custom balloons to integrate their brand identity into an event environment through familiar colors, typefaces, and messages that people recognize from previous experiences with them. When used alongside banners, table coverings, or brochures for increased professionalism.

Consistency in visuals helps people recall your brand. Repeated exposure of logo or message throughout an event – even for just short time frames – has the ability to leave lasting memories with participants that build relationships between attendees. Over time, these reminders help strengthen mutual understanding among attendees.

Promote Interaction And Engagement

Not being noticed at events alone isn’t enough; engagement must also happen between attendees. Balloons inherently make people engage, particularly at locations that stimulate mobility and exploration; many visitors often stop for photos, questions, or free balloons at these events.

Businesses often utilize custom printed balloons at events to encourage participation from attendees and expand the brand message beyond the event, reaching people both physically and on social media, by giving attendees balloons as souvenirs of an experience or product demonstrations. When attendees take balloons home with them from these activities and carry the brand message out into the region and beyond social media, more people receive information from this brand message about its existence than would normally come through at just a one-day conference event itself.

Help With Affordable Event Marketing

Balloons can be an inexpensive and impactful way to promote any message or event, especially since their cost per impact can be so minimal. Balloons are easy to produce in large volumes at little expense; transportable; quick to set up; making them appealing solutions for firms attending many events with limited marketing resources or attending many similar occasions.

Balloons can make any room pop with color. By taking advantage of the balloon’s eye-catching nature, even small quantities may drastically transform its aesthetics, enabling businesses to spend their budget more wisely while creating an eye-catching presence that still gets people talking and involved.

Acclimatizing To Various Events And Situations

One of the greatest things about custom printed balloons is their versatility – they work for many events and businesses alike! Companies use balloons at conferences, networking events, grand openings, and sales events; stores use them during grand openings; nonprofit organizations can utilize balloons as fundraising devices, while community groups make use of balloons to raise money and spread awareness for their cause.

Make the balloon designs reflect the occasion: bright colors and eye-catching messages might work well at festivals and family reunions; more muted hues with less branding can work for professional settings or meetings. By accommodating to different events’ moods and settings, balloons remain interesting to a wide range of people.

Use Balloons In Your Plan

Balloons work great when integrated into an overall event marketing plan, which should include clear messages, courteous personnel interactions, and strong calls-to-action. Businesses that excel are those that carefully consider where things will be put while matching designs to the goals of an event.

Businesses often enlist skilled promotional partners such as Perfect Imprints to ensure that the balloon designs meet brand guidelines and event goals, thus turning a simple item into an effective marketing tool.

Final Thoughts

To stand out in competitive event venues, companies need to use visual elements creatively and with purposeful intent. Custom-printed balloons offer companies an effective means of drawing attention without overcomplicating their approach – when used strategically, they provide unforgettable memories and will stay with people long after an event has concluded.

Business

Understanding Your Rights in a Building Dispute

Construction disputes are generally tense and complex for homeowners builders contractors. Your awareness of your rights in the event of a dispute is essential to effective settlement of the dispute. Delays substandard work contract breaches or payment problems are all possible elements of such disputes. Confidence to deal effectively with the problems can be gained through acquaintance with the legal construct of construction contracts. Misunderstanding or vague words of a contract usually cause disputes that can bring in confusion to the two parties. Protection of your interests entails your knowledge of your own legal responsibilities and rights as a builder or a homeowner.

When Should You Hire a Building Disputes Solicitor?

Seeking legal advice at an early stage is important in the case of a construction dispute. If a dispute with a contractor or homeowner gets out of hand beyond simple miscommunication legal guidance may be necessary. Your rights will be protected and your case will be dealt with properly if you instruct a solicitor. A building disputes solicitor can provide you with the tools you require to proceed with your dispute by clearly establishing your rights and responsibilities under the contract. They can help you decide if the most appropriate action is arbitration mediation or litigation. By helping to resolve the conflict amicably their intervention may sometimes prevent it from escalating.

How Solicitors Help Resolve Disputes Over Variations and Change Orders

Change orders and variation clauses are standard in construction contracts and they sometimes result in conflict. Because of unforeseen occurrences or changing requirements during the project these clauses authorize changes to the original scope of work. However there could be conflicts regarding the scope of the changes or associated costs. A building disputes solicitor can prove to be extremely useful in such circumstances with regards to understanding the conditions of the contract. They will help establish if the prescribed procedures for authorizing variations have been complied with and if the variation orders are within the contract terms. In a bid to reflect changes precisely solicitors also help in preparing addenda or contract amendments. For additional work they can verify the billing to ensure that it is fair and according to the contract.

By obtaining legal counsel both sides can avoid misunderstandings and miscommunications that may lead to long and costly court cases. In some instances lawyers may suggest mediation or negotiation as other dispute resolution methods which can lead to faster and more cost-effective settlements. If a settlement is not possible in more serious cases the attorney can prepare for litigation and represent your interests in court.

Dealing with Owner-Builder Disputes: What Legal Protections Apply?

While dealing with owner-builder disputes is sometimes challenging it is very important to know your legal rights. Owner-builders are obligated by law in most jurisdictions to comply with specific insurance and licensing regulations which act to protect both parties in future disputes. If issues arise such as construction defects delays or payment disputes the owner or contractor can seek recourse under consumer protection or contract law. Owner-builders generally must provide guarantees in relation to the materials and workmanship for a set period as per the law. It is often recommended that mediation or arbitration be considered prior to going to court if the dispute cannot be resolved through friendly settlement. By getting the services of a lawyer at the earliest you can make sure that you comply with correct procedures and avoid costly mistakes by having your rights and duties explained. With the correct documents like signed agreements variation orders and letters you can increase the chances of a lawsuit victory. Owner-builder disputes can be resolved ultimately faster fairly and with less hassle if you know your rights and have professional guidance.

Business

Unlocking Growth: Essential Strategies for Small Business Success

In the fast-paced realm of entrepreneurship, small businesses face both thrilling opportunities and formidable challenges on the path to growth. The journey from fledgling startup to thriving enterprise is fraught with pivotal decisions that can spell success or failure. With market dynamics in perpetual motion, how does one ensure a business not only survives but thrives? The secret lies in unlocking the right strategies that cater to scalability, financial robustness, and market adaptability. This article delves into the essential considerations small business owners must keep in mind to steer their ventures toward sustained growth and success.

Growing Pains or Gains Ensuring Scalability Without Compromising Quality

As a small business owner, envisioning growth is exciting, but it also comes with its own set of challenges. One critical aspect to address is scalability. Can your business model expand without sacrificing quality or customer satisfaction? By focusing on scalability, you can streamline operations and optimize processes, achieving economies of scale that lower costs per unit as your business grows. This means enjoying higher profit margins without compromising the value delivered to your customers. Efficient resource allocation is key, ensuring that time, money, and manpower are directed towards essential tasks. This flexibility allows your business to remain responsive to market changes, setting the stage for long-term success.

Financial Foundations Crafting a Blueprint for Business Growth

Funding your growth initiatives requires a solid financial strategy. It’s crucial to develop a comprehensive financial plan that includes effective budgeting, meticulous cash flow management, and exploring diverse funding sources. By setting clear financial goals aligned with your strategic aims, such as market expansion or operational efficiency, you can ensure your budget is actionable. Implementing a robust cash flow monitoring system is vital to maintain liquidity and avoid financial shortfalls. Additionally, diversify your funding portfolio by exploring options like crowdfunding or angel investors. This multidimensional approach not only supports immediate growth opportunities but also builds resilience against financial uncertainties.

Brand Brilliance Enhancing Your Presence Through Strategic Marketing

To capture a wider audience, enhancing your brand identity and marketing strategy is essential. As we move into 2025, integrating trends like artificial intelligence, short-form videos, and sustainable practices will redefine consumer engagement. Strengthening your brand involves creating a memorable experience that resonates with your target market. A data-driven approach allows you to personalize marketing efforts, increasing engagement and brand loyalty. By continuously refining your communication techniques and leveraging social proof, you can effectively highlight the unique benefits of your offerings and stand out in a competitive market.

Digital Dreams Realized Transforming Your Business for Growth

In today’s fast-paced market, digital transformation is crucial for small businesses aiming to streamline operations and boost competitiveness. Embracing technologies such as cloud computing and advanced AI can scale your operations and enhance customer experiences by personalizing engagement and improving efficiency. Digital initiatives can significantly uplift customer satisfaction and loyalty, driving higher revenue and market share. Integrating digital strategies isn’t just an option for survival; it’s a pathway to thriving in an increasingly competitive landscape.

Building a Dream Team Enhancing Talent Retention Through Culture

Cultivating an organizational culture that attracts and retains top talent is essential for business growth. This involves fostering effective team dynamics where open communication, learning opportunities, and diversity are prioritized. A competitive workplace environment is crucial, as many employers struggle with employee retention and attracting new talent. By establishing an appealing employee value proposition, you can significantly reduce turnover costs. Creating a supportive and inclusive atmosphere not only enhances employee satisfaction but also drives long-term business success.

Insight-Driven Triumphs Harnessing Market Insights for Strategic Growth

Thriving in a competitive marketplace requires thorough market research and competitive analysis. Understanding emerging trends allows you to identify new opportunities and potential threats that impact your business growth. Evaluating competitors’ offerings and customer feedback provides a clear comparative landscape. Regularly assessing your strengths and weaknesses using SWOT analysis ensures adaptability to market changes. These insights inform strategic decisions, helping you create innovative strategies that propel your business forward.

Efficient Invoicing for Seamless Expansion

A consistent and simple invoicing system is essential for expanding your small business efficiently. By using an online invoice builder, you can generate professional invoices that reflect your brand identity, including your logo and company colors. Setting precise payment terms and issuing invoices promptly enhances your cash flow management, ensuring timely payments. Offering various payment options caters to diverse customer preferences, reducing barriers to payment and fostering stronger client relationships. Embracing customizable invoice templates allows you to save time and effort, ultimately freeing up resources to focus on strategic growth initiatives.

The road to small business growth is far from linear; it’s a dynamic journey filled with evolving challenges and opportunities. As you navigate this ever-changing landscape, remember that success hinges on adaptability, resilience, and strategic foresight. By embracing scalable operations, crafting robust financial plans, and leveraging modern marketing and digital tools, you align your business with the demands of tomorrow’s market. Moreover, fostering an organizational culture that prioritizes talent retention and capitalizing on market insights can propel your venture forward. The canvas of small business is vast, painted with the vibrant hues of innovation and perseverance. Let these considerations guide your brush strokes as you create a masterpiece of sustainable growth and enduring success.

Business5 years ago

Business5 years agoFind out how useful a loan is without a credit check

Digital Marketing4 years ago

Digital Marketing4 years agoIs YouTube Marketing Capable of Taking Your Business to the Next Level?

Food4 years ago

Food4 years ago5 Best and Worst Foods for Boosting Metabolism

Business4 years ago

Business4 years agoContent Creation Tips Every Digital Manager Needs to Know

Business3 years ago

Business3 years agoBest Workplace Upgrade

Lifestyle4 years ago

Lifestyle4 years agoHow to Choose the Best Air Fryer for Me

Fashion4 years ago

Fashion4 years ago8 Top Leather Jacket Picks To Try Out This Year

Tech5 years ago

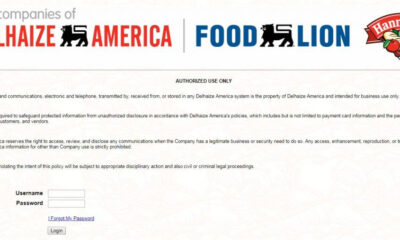

Tech5 years agoFood Lion Employee Login at ws4.delhaize.com – MyHR4U